Florida civil litigation lawyers rely on a few basic Internet reference resources in almost every case. Some are free, others are not.

The free links include:

Florida civil litigation lawyers rely on a few basic Internet reference resources in almost every case. Some are free, others are not.

The free links include:

When it comes to the civil justice system, the U.S. Chamber of Commerce is a hypocritical ass.

When it comes to the civil justice system, the U.S. Chamber of Commerce is a hypocritical ass.

While the U.S. Chamber of Commerce spends millions of dollars and focuses immense resources on lobbying campaigns aimed at limiting regular consumers’ access to the courthouse – the group’s affiliate, the Institute for Legal Reform, works every day to add barriers and restrictions to the right of individuals harmed by corporations to file lawsuits against corporations – the National Chamber Litigation Center, the part of the organization charged with filing lawsuits on behalf of the group, annually initiates over 130 suits, more than 2 a week.

In October, 2010, Chamber President and CEO Tom Donohue explained that litigation is, “one of our most powerful tools for making sure that the federal agencies follow the law and are held accountable.”

The newspaper article reproduced below, written in 2003, does an excellent job of illustrating the importance of having strong bad faith insurance laws designed to persuade insurance companies to settle cases for fair value rather force every case to trial.

Florida’s bad faith laws impose a duty on insurance companies to act in the best interests of their insureds (customers). If an insurance company can and should settle a case within its insured’s policy limits, it should. If the insurance company refuses and a final judgment in excess of the limits is then entered against the insured, the company may be forced to pay the full judgment, not just the policy limits.

Whether or not the carrier must pay the full judgment depends on the manner in which it handled the claim. If, based on all available information, the carrier could have and should have settled the case within the policy limits, it may very well be required to pay the full judgment … as it should for needlessly exposing its insured to a significant money judgment.

Without meaningful bad faith laws, insurance companies would never settle cases within policy limits. Knowing that the most they will ever have to pay is what they should pay anyway, i.e., the policy limits, they will force every case to trial. Their purpose in taking every case to trial will be to put plaintiffs’ lawyers on notice that to avoid trial, every case must be settled for less than policy limits, even cases worth much more than policy limits.

Without strong bad faith insurance laws, the only parties that will be exposed to excess judgments will be the insureds, those who purchase the insurance coverage to avoid such a scenario.

Under Governor Rick Scott, the Florida Legislature will attempt to gut Florida’s bad faith laws. From their point of view, insurance company profits are more important than protecting individuals.

********************************************************************************

Bad faith in the law

By MARTIN DYCKMAN Published December 21, 2003

——————————————————————————–

TALLAHASSEE – The malpractice debate last summer was an emotional roller coaster ending in bitter disappointment for Florida physicians whose leaders had convinced them that there would be no relief from high insurance premiums without a flat $250,000 ceiling on pain and suffering awards. That line came straight from the insurance lobby, which actually wanted something else a lot more, and got it.

To the insurers, the more important goal was to erode Florida’s bad-faith law, which they blame for forcing them to settle cases they say they shouldn’t. That premise is partly true; the law is intended to encourage settlements and avoid costly trials. But legislators heard only opinion, not evidence, as to whether there are really too many before agreeing to make the doctors the guinea pigs in a dangerous experiment.

To illustrate what’s at stake, let’s look at the outcome of an important trial at Clearwater earlier this month. It involved an automobile accident, not medical malpractice, but the principles are the same. My colleague William R. Levesque reported the story in the Dec. 5 St. Petersburg Times.

The plaintiff was Xiao-Cao Sha, a 41-year-old violinist who suffered severe shoulder and neck injuries in a collision that the defense conceded to be the fault of the driver who had run a red light and hit the car in which Sha was a passenger. Sha, who had left the Florida Orchestra to seek opportunities in major orchestras, can no longer play without severe pain and can practice only 15 minutes a day. The defense didn’t question that either.

The other driver was unusually well insured – for $1.75-million, says Sha’s lawyer, Tom Carey – and Carey offered to settle for that. He might have settled for even less, I gathered, but not for as little as the defendant’s carrier, Liberty Mutual, was willing to pay.

According to Carey, “they never made it to $200,000.”

So the case went to trial, where Liberty Mutual’s lawyer contended that Sha should be awarded no more than $189,000 because there was no guarantee she could have fulfilled her dreams and might never have earned more than $30,000 a year, her former salary with the Florida Orchestra. She could still have earned that, the lawyer said, by teaching and performing solos.

Imagine for a moment that the victim had been a young doctor about to start practice as a neurosurgeon and an insurance company had proposed that he or she settle for pediatrics or some other specialty that earns much less. Any red-blooded jury would have socked that company at least as hard as Sha’s did.

The jury took less than hour to award her $5-million, which included some $1,375,000 for lost future wages and $3,456,000 for pain and suffering. More than twice, all told, the limits of the policy that the defendant and her husband had paid for and Sha would have accepted.

Continue reading

In Greenfield v. Daniels (November 24, 2010), the Florida Supreme Court decided that paternity of a child could be determined in the course of a wrongful death proceeding under Chapter 768, Fla. Statutes rather than in a paternity proceeding under Ch. 742, Fla. Stat. The Court’s decision disapproved the conflicting decision of a lower appellate court in Achumba v. Neustein, 793 So.2d 1013 (Fla. 5th DCA 2001).

In Greenfield, the bioligical father of a minor child committed suicide. A wrongful death action was brought by the estate of the decedent against a psychiartist (and a hospital) for allegedly negligently discharging him. A claim was made for the minor as a “survivor” under the statute. However, the doctor challenged the child’s status as a “survivor,” claiming that the child’s status could not be established after the purported father’s death.

The legal question at issue was whether or not paternity could be established in the wrongful death proceeding.

Continue reading

At the urging of Governor Jeb Bush, Florida’s Republican-controlled legislature in 2002 passed a workers’ compensation bill designed to limit carrier-paid attorney’s fees to claimants’ attorneys. The measure was challenged in the courts by claimants (injured workers), who argued that it was unconstitutional (denied access to courts & equal protection) and that it should be interpreted to allow for “reasonable” attorney’s fees.

Five years after the bill’s effective date, the Florida Supreme Court, in Murray v. Mariner Health and Ace USA, 994 So.2d 1051 (Fla.2008), held that the statute provided for reasonable attorney’s fees. The court did not rule on the constitutional issues.

In a clear rebuke to the Florida Supreme Court, in it’s next legislative session, which began on March 1, 2009, less than seven months after the Murray decision, the still-again Republican-controlled legislature took another shot at limiting fees. What it did was remove the word “reasonable” from Florida Statute 440.34. The Legislature’s goal was to make it difficult for injured workers to obtain adequate legal representation by denying their attorneys reasonable attorney’s fees.

In the Murray case, Ms. Murray was successful at the trial level in convincing a judge of workers’ compensation claims (JCC) that her injuries were sustained in a work-related accident. (The employer/carrier (e/c) had denied her injuries.) In a subsequent attorney’s fee hearing, the JCC found that claimant’s counsel expended eighty hours of reasonable and necessary time on the case. However, the JCC, although concluding in his written order that $16,000 was a reasonable fee, felt constrained by the statute and awarded only $684.84, or an hourly rate of $8.11. According to the JCC, this amount was “manifestly unfair.” (Note: the e/c in this case paid their attorney $16,050 (135 hours at $125 an hour) in the unsuccessful effort to resist paying benefits.) It was this order that was appealed and eventually made its way to the Florida Supreme Court. As a result of the decision, Ms. Murray’s attorney was awared $16,000 for his efforts at the trial level.

Continue reading

Epidemiology is the study of patterns of health and illness and associated factors at the population level. Forensic (applying science to answer questions of interest to a legal system) epidemiology can be useful in personal injuries cases to prove causation of an injury.

Epidemiology is the study of patterns of health and illness and associated factors at the population level. Forensic (applying science to answer questions of interest to a legal system) epidemiology can be useful in personal injuries cases to prove causation of an injury.

The personal injury claimant has the burden of proving that his/her injuries or conditions were more likely than not caused by an accident or offending agent (e.g., smoking). This burden becomes more difficult when the complained of injuries and conditions can occur naturally without a known precipitating cause. Examples include herniated intervertrebral discs and lung cancer.

Various types of experts, including doctors and biomechanists, are used on both sides to present evidence regarding the issue of causation. The expertise of forensic epidemiologists is greatly underutilized.

Epidemiologists use “relative risk” to compare the chance of injuries and conditions being caused in certain ways. Two examples: (1) The risk of an intervertebral disc injury from a crash is 1 in 200, while the risk of an individual developing the symptoms at the same point in time if the crash hadn’t occurred is usually less than 1 in 100,000. (2) The chance that a person who smokes will get lung cancer is 20% compared to 1% for non-smokers.

A common defense tactic in civil justice cases is to propose alternative explanations for the injuries/conditions besides the targeted accident or exposure. The defendant’s hope is that a jury will attribute the damage to something other than the accident or exposure. The epidemiologist can be an important expert to counter the shifting-blame defense.

Continue reading

From time to time, I will post to my blog site the writings of other individuals on legal topics of interest to me. For those familiar with my own blogs, it is clear that I strongly oppose efforts to limit the authority of juries to render just verdicts. Particularly insidious, in my view, are laws that limit damage caps.

From time to time, I will post to my blog site the writings of other individuals on legal topics of interest to me. For those familiar with my own blogs, it is clear that I strongly oppose efforts to limit the authority of juries to render just verdicts. Particularly insidious, in my view, are laws that limit damage caps.

For the most part, it is Republicans who are leading the charge on behalf of big business to curtail the rights of individuals to seek redress within the framework of the civil justice system. Profits over People. That Republicans would be leading the charge has always struck me as running counter to their oft-stated message of personal accountability, responsibility, and consequences for bad acts. “Tort Reform,” as big business propogandists like to call it – or, as I prefer to call it, “Tort Deform” – seeks to protect corporations from consequences, accountability, and responsibility.

Sadly, you never hear Republicans, much less prominent Republicans, speaking out against “Tort Reform.” Until now.

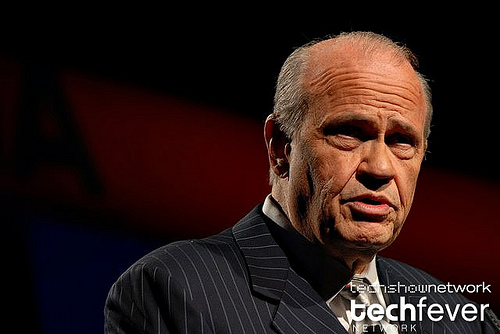

Fred Dalton Thompson (born August 19, 1942), is an American politician, actor, attorney, lobbyist, columnist, and radio host. He served as a Republican U.S. Senator from Tennessee from 1994 through 2003, and ran for the 2008 Republican presidential nomination. He opposes “Tort Reform.”

The following piece, written by Mr. Thompson, was recently brought to my attention. I found that it contained thoughtful and compelling arguments against “Tort Reform.” Kudos to Mr. Thompson. Here’s the opinion piece:

I have been asked why I want to take part in the discussions when the state legislature considers changes to our civil justice system in Tennessee. I am certainly aware of the ideological boxes that advocates like to put folks in when it comes to “tort reform.”

Republicans and conservatives are supposed to be for anything called tort reform. However, I’ve never subscribed to these boxes. Not when I was in the U.S. Senate faced with these issues, and not now.

Some argue that the legislature should tell Tennessee juries that they can award only so much compensation in certain types of cases against certain types of defendants — regardless of the facts and circumstances of the case. I don’t agree with this approach, and I don’t think it’s “conservative.”

To me, conservatism shows due respect for a civil justice system that is rooted in the U.S. Constitution and is the greatest form of private regulation ever created by society. Conservatism is individual responsibility and accountability for damages caused, even unintentionally. It’s about government closest to the people and equal justice with no special rules for anybody. It’s also about respect for the common-law principle of right to trial by jury in civil cases that was incorporated into the Seventh Amendment to the Constitution.

Continue reading

Florida no longer recognizes the principle of joint and several liability with regard to satisfying final judgments rendered in personal injury cases. Under the concept of joint and several liability, one liable defendant could be forced to pay for the fault of other defendants. One of the theories behind the concept is that the damages would not have occurred but for that party’s fault, so make each party whose fault formed part of the chain leading to the total damages, liable for the fault of all.

Where one or more of the at-fault defendants did not have the financial means to pay its share of the damages, a defendant could be stuck with paying a disproportionate share of the judgment relative to its degree of fault. This procedure worked to the benefit of plaintiffs, who could turn to any defendant to satisfy the whole judgment. Consider this example: The drivers of a Coca-Cola truck and an uninsured vehicle are found equally at-fault for causing a horrible highway accident resulting in the death of a minor child in a third vehicle. At trial the jury awards damages totaling $5,000,000 and a final judgment is entered in this amount. Under joint and several liability, the Coca-Cola company can be forced to satisfy the entire judgment, although the jury has decided that its driver was only 50% at-fault. With the elimination of joint and several liability by the Florida Legislature, plaintiffs can no longer rely on any defendant to satisfy the entire judgment. Under current law, in my example, Coca-Cola would have to pay $2,500,000 instead of the full $5,000,000 final judgment.

What about when a violent crime is committed and a negligent security case is brought against the property owner and/or party in possession of the property for failing to prevent the crime? As between the property owner/possessor and the perpetrator of the crime, does the property owner get a discount on its liability to the extent of the perpetrator’s role in the event? Thankfully, the answer is a resounding No.

Fabre v. Marin, 623 So.2d 1182 (Fla.1993) is the Florida Supreme Court case that requires the allocation of fault among all negligent parties, including the plaintiff. The jury makes the determination and provides its answer on what is called the Jury Verdict Form. The verdict form will contain the name of everyone accused of being at-fault, even those not a party to the lawsuit, and the jury will determine the percentage of fault of each. Each defendant pays no more than its percentage of fault, regardless of whether or not any other at-fault defendant has the financial means to satisfy its share of the final judgment. No longer can the plaintiff look to one defendant to satisfy more than its share of a judgment.

Continue reading

Helpful tips to reduce identify theft:

Here is some important information to limit the damage in case your ID or identity are stolen:

Here are the numbers you always need to contact with regard to your missing or stolen wallet:

I voted for President Obama and fully expect to vote for him again in 2012. However, I am disappointed by one of his remarks delivered in the 2011 State of the Union message. In speaking about taking steps to improve the economy, the president mentioned that he is willing to work with the Republicans on medical malpractice reform legislation. I am hoping that his words were only rhetoric, chum if you will, to get a few cheers from the Republicans during the address, rather than an expression of his true intentions.

Among the lawyers who handle medical malpractice cases and know the realities of this practice area beyond the rhetoric, the word “deform” is substituted for the word “reform.” This is because the word “reform” suggests a good thing, while the word “deform” imparts a whole different meaning.

Make no mistake about it, the medical malpractice “reform” favored by Republicans is not a good thing for individuals harmed by serious medical mistakes. Their idea is to make it more difficult, if not completely impractical, for individuals harmed by medical negligence to seek redress through the civil justice system. I consider this a bad thing rather than a good thing, hence the use of the word “deform.”

For many years, powerful forces, in particular, the insurance industry, have pounded into the psyche of American society that our country faces a medical malpractice crisis. However, the truth is far different than the propoganda.

Continue reading