I remember the night, in 1964, that a young Cassius Clay defeated world champion Sonny Liston at the Miami Beach Convention Center. I waited anxiously by the radio for a report of the outcome. He was expected to be eaten alive by the big bad bear Liston and become a footnote in the history books. I was more relieved that he wasn’t hurt than excited about the victory. The next day Cassius Clay became Muhammad Ali, and the rest is much, much more than a footnote in the history books.

I remember the night, in 1964, that a young Cassius Clay defeated world champion Sonny Liston at the Miami Beach Convention Center. I waited anxiously by the radio for a report of the outcome. He was expected to be eaten alive by the big bad bear Liston and become a footnote in the history books. I was more relieved that he wasn’t hurt than excited about the victory. The next day Cassius Clay became Muhammad Ali, and the rest is much, much more than a footnote in the history books.

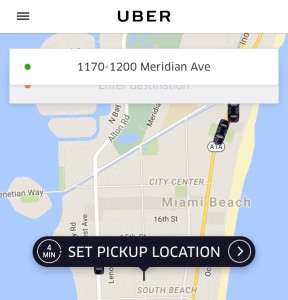

While his ring exploits are legendary — Olympic Gold Medal, the Thrilla in Manila, dismantling George Foreman in 8 rounds in Zaire, Africa in the fight known as The Rumble in the Jungle — his greatness came from the character he demonstrated both in the ring and out. In refusing to participate in an unconscionable conflict — the United States never formally declared war in the so-called Vietnam War — in defiance of White Establishment America, he was stripped of his world title, barred from fighting for three and a half years during the prime of his physical prowess, and convicted of draft evasion and sentenced to five years in prison. Instead of complaining, he fought the conviction all the way to the United States Supreme Court and had it reversed by an 8-0 vote.

Florida Injury Attorney Blawg

Florida Injury Attorney Blawg